Feb 3, 2023Supplies expense in accounting refers to the cost of a collection of goods that the company used during a specific reporting period to operate. Staff members may use these items regularly to complete their daily tasks. For example, an accountant might consider ink cartridges for the office printer as a supplies expense.

What Is a Trial Balance? Everything You Need to Know (2024) – Shopify USA

Cash Expenses The $1,000 debit shows that your total office supplies expenses increased by $1,000. The $1,000 credit to the cash account represents the money leaving your business’s bank account.

Source Image: creately.com

Download Image

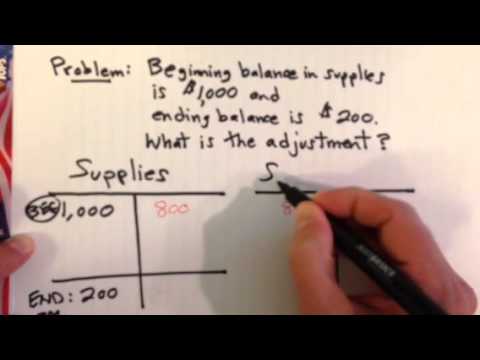

Mar 14, 2023At the end of the accounting period the business needs to record the adjustment of 150 to the consumable supplies on hand account. The following journal entry is used. The supplies expense has increased by 150 and the supplies on hand has decreased by the same amount. The Accounting Equation

Source Image: m.youtube.com

Download Image

What Are Accrued Expenses In Business? – Innovature BPO

Mar 13, 2023Supplies Expense. At the end of the accounting period, the supplies on hand are counted and the movement recorded as an expense item in the income statement.. Suppose in the above example, the beginning supplies on hand were 1,200, and the ending supplies on hand were 900, then the supplies expense for the period would be calculated as follows:

Source Image: accountlearning.com

Download Image

When Should Supplies Be Recorded As An Expense

Mar 13, 2023Supplies Expense. At the end of the accounting period, the supplies on hand are counted and the movement recorded as an expense item in the income statement.. Suppose in the above example, the beginning supplies on hand were 1,200, and the ending supplies on hand were 900, then the supplies expense for the period would be calculated as follows:

Feb 21, 2023Make an adjusting entry on 31 December 2016 to record the supplies expense Solution 1. When supplies are purchased 2. When cost of supplies used is recorded as supplies expense Supplies expense for the period = $500 – $150 = $350 Adjusting Entry for Supplies Expense FAQs What is the purpose of adjusting entry at the end of accounting period?

Guidelines to minimize stationery expense

Nov 7, 2023Bookkeeping Guidebook If the cost of the supplies that you have purchased and not yet consumed is significant, then you can instead record them as an asset, using the following entry: By using this later approach, the supplies will appear on your balance sheet as a current asset, until you use them and charge them to expense with this entry:

Current Assets: Definition, Examples, and Formula (2023) – Shopify USA

Source Image: shopify.com

Download Image

Why can’t China just attack India and probably take more territories knowing China would most likely win considering it won the Sino-Indian War in 1962? – Quora

Nov 7, 2023Bookkeeping Guidebook If the cost of the supplies that you have purchased and not yet consumed is significant, then you can instead record them as an asset, using the following entry: By using this later approach, the supplies will appear on your balance sheet as a current asset, until you use them and charge them to expense with this entry:

Source Image: quora.com

Download Image

What Is a Trial Balance? Everything You Need to Know (2024) – Shopify USA

Feb 3, 2023Supplies expense in accounting refers to the cost of a collection of goods that the company used during a specific reporting period to operate. Staff members may use these items regularly to complete their daily tasks. For example, an accountant might consider ink cartridges for the office printer as a supplies expense.

Source Image: shopify.com

Download Image

What Are Accrued Expenses In Business? – Innovature BPO

Mar 14, 2023At the end of the accounting period the business needs to record the adjustment of 150 to the consumable supplies on hand account. The following journal entry is used. The supplies expense has increased by 150 and the supplies on hand has decreased by the same amount. The Accounting Equation

Source Image: innovatureinc.com

Download Image

Essential Steps To Build The Best Outsourcing Strategy For Your Company

If you initially record office supplies as an asset, they become an expense when you use them. In that case, you would make an adjusting entry in your accounting records at the end of the

Source Image: innovatureinc.com

Download Image

Supplies and Supplies Expense Adjustment – YouTube

Mar 13, 2023Supplies Expense. At the end of the accounting period, the supplies on hand are counted and the movement recorded as an expense item in the income statement.. Suppose in the above example, the beginning supplies on hand were 1,200, and the ending supplies on hand were 900, then the supplies expense for the period would be calculated as follows:

Source Image: m.youtube.com

Download Image

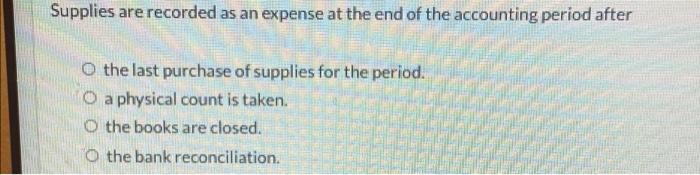

Solved Supplies are recorded as an expense at the end of the | Chegg.com

Feb 21, 2023Make an adjusting entry on 31 December 2016 to record the supplies expense Solution 1. When supplies are purchased 2. When cost of supplies used is recorded as supplies expense Supplies expense for the period = $500 – $150 = $350 Adjusting Entry for Supplies Expense FAQs What is the purpose of adjusting entry at the end of accounting period?

Source Image: chegg.com

Download Image

Why can’t China just attack India and probably take more territories knowing China would most likely win considering it won the Sino-Indian War in 1962? – Quora

Solved Supplies are recorded as an expense at the end of the | Chegg.com

Cash Expenses The $1,000 debit shows that your total office supplies expenses increased by $1,000. The $1,000 credit to the cash account represents the money leaving your business’s bank account.

What Are Accrued Expenses In Business? – Innovature BPO Supplies and Supplies Expense Adjustment – YouTube

If you initially record office supplies as an asset, they become an expense when you use them. In that case, you would make an adjusting entry in your accounting records at the end of the